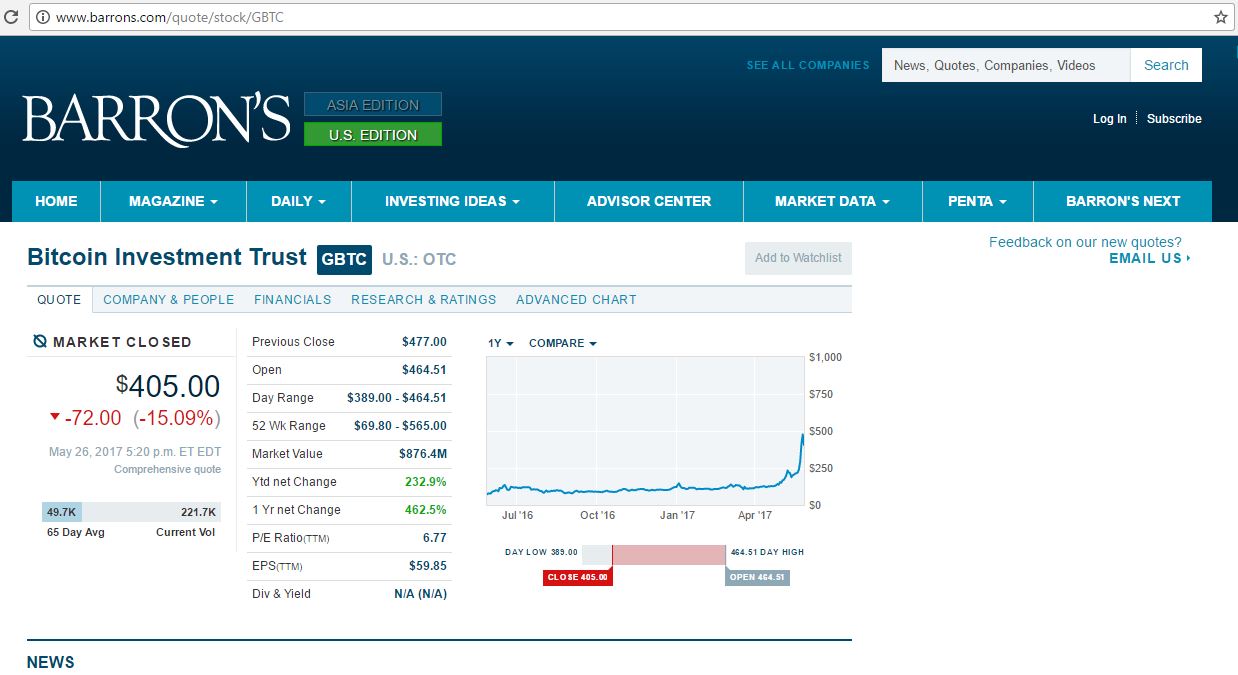

'GBTC' (Ticker Symbol) - Bitcoin Investment Trust

OTC Markets

Over the Counter Stock Market

Excerpt:

Business Description

Bitcoin Investment Trust is a private, open-ended trust that is invested exclusively in bitcoin and derives its value solely from the price of bitcoin. It enables investors to gain exposure to the price movement of bitcoin without the challenge of buying, storing, and safekeeping bitcoins. The BIT's sponsor is Grayscale Investments, a wholly-owned subsidiary of Digital Currency Group.

Each BIT share represented ownership of 0.1 bitcoins initially. The trust will not generate any income and regularly sells/distributes bitcoins to pay for its ongoing expenses. Therefore, the amount of bitcoin represented by each share gradually declines over time.

View the complete presentation at:

http://www.otcmarkets.com/stock/GBTC/profile

Grayscale Investments files to list its bitcoin trust on NYSE

MarketWatch

by Joseph Adinolfi

1/20/2017

Grayscale Investments has filed to list its Bitcoin Investment Trust, GBTC on the New York Stock Exchange in a $500 million initial public offering, according to documents submitted to the Securities and Exchange Commission on Friday. Shares of the trust, which presently trades over the counter, have been trading at a premium to the bitcoin price. The trust, which back in 2013 and exclusively invests in bitcoin, is one of the only options available to institutional investors wishing to gain exposure to the currency. The Bank of New York Mellon will serve as the transfer agent for shares of the fund, and Xapo Inc., a bitcoin wallet and vault company, will serve as custodian of the trust's bitcoins. The application comes as the SEC is mulling whether to approve two proposed bitcoin exchange-traded funds. If approved, they would be the first ETFs exclusively focused on bitcoin.

View the original post at:

http://www.marketwatch.com/story/gra...yse-2017-01-20

BRAVE NEWCOIN - Digital Currency Insights

Re: GBTC

by Alex Sunnarborg

View the complete post, including images, at:

http://bravenewcoin.com/news/gbtc-no...asset-bitcoin/

This page updated 2/6/2017

OTC Markets

Over the Counter Stock Market

Excerpt:

Business Description

Bitcoin Investment Trust is a private, open-ended trust that is invested exclusively in bitcoin and derives its value solely from the price of bitcoin. It enables investors to gain exposure to the price movement of bitcoin without the challenge of buying, storing, and safekeeping bitcoins. The BIT's sponsor is Grayscale Investments, a wholly-owned subsidiary of Digital Currency Group.

Each BIT share represented ownership of 0.1 bitcoins initially. The trust will not generate any income and regularly sells/distributes bitcoins to pay for its ongoing expenses. Therefore, the amount of bitcoin represented by each share gradually declines over time.

View the complete presentation at:

http://www.otcmarkets.com/stock/GBTC/profile

Grayscale Investments files to list its bitcoin trust on NYSE

MarketWatch

by Joseph Adinolfi

1/20/2017

Grayscale Investments has filed to list its Bitcoin Investment Trust, GBTC on the New York Stock Exchange in a $500 million initial public offering, according to documents submitted to the Securities and Exchange Commission on Friday. Shares of the trust, which presently trades over the counter, have been trading at a premium to the bitcoin price. The trust, which back in 2013 and exclusively invests in bitcoin, is one of the only options available to institutional investors wishing to gain exposure to the currency. The Bank of New York Mellon will serve as the transfer agent for shares of the fund, and Xapo Inc., a bitcoin wallet and vault company, will serve as custodian of the trust's bitcoins. The application comes as the SEC is mulling whether to approve two proposed bitcoin exchange-traded funds. If approved, they would be the first ETFs exclusively focused on bitcoin.

View the original post at:

http://www.marketwatch.com/story/gra...yse-2017-01-20

BRAVE NEWCOIN - Digital Currency Insights

Re: GBTC

by Alex Sunnarborg

View the complete post, including images, at:

http://bravenewcoin.com/news/gbtc-no...asset-bitcoin/

This page updated 2/6/2017

Comment